|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

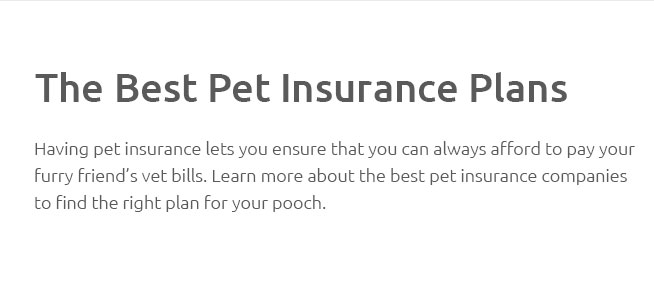

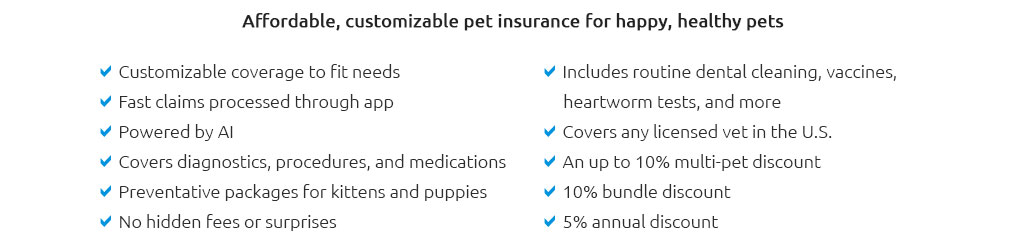

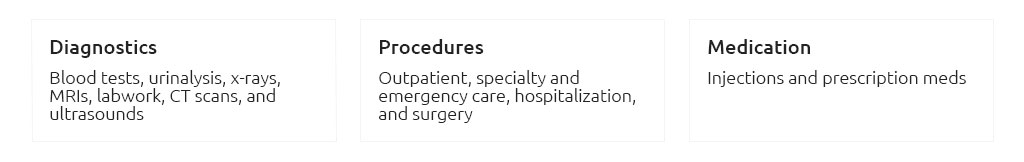

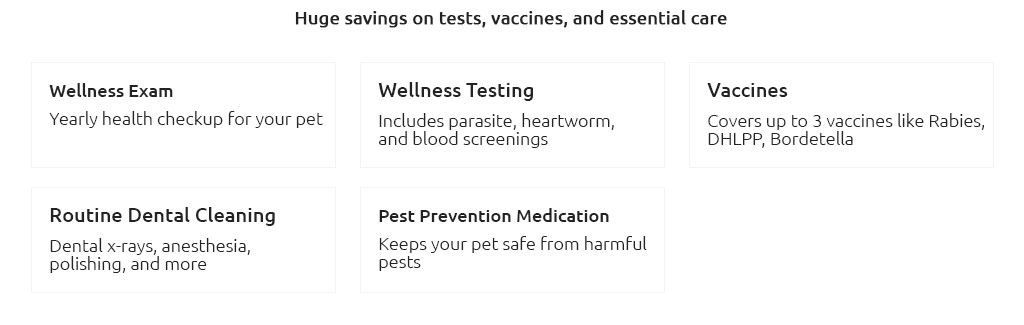

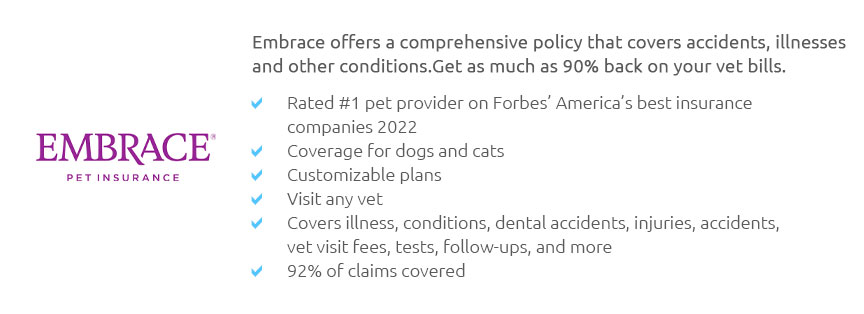

Understanding Low Cost Multi Pet Insurance: A Comprehensive GuideIn an era where pet ownership has surged, ensuring the well-being of our furry companions without breaking the bank is a priority for many. Low cost multi pet insurance emerges as a viable option for households with more than one pet, offering both financial relief and peace of mind. While the appeal is undeniable, selecting the right policy requires careful consideration and awareness of common pitfalls. Multi pet insurance, at its core, is designed to provide coverage for multiple animals under a single policy. The allure of such packages often lies in their discounted rates compared to individual policies, making them particularly attractive to families with several pets. However, as with any financial commitment, it is crucial to approach the selection process with a discerning eye. One common mistake to avoid is neglecting to compare the specifics of coverage. It is essential to scrutinize what each policy entails, as coverage can vary significantly between providers. Some policies may cover only accidents, while others include routine check-ups and vaccinations. Ensuring that the plan aligns with your pets' needs is paramount. Another frequent oversight is overlooking the exclusions and limitations that are often tucked away in the fine print. Pre-existing conditions, breed-specific ailments, and age restrictions can all impact the extent of coverage. It is advisable to have a thorough discussion with the insurance provider to clarify these aspects before committing. The temptation to opt for the cheapest policy available can be strong, but it is crucial to balance cost with comprehensive coverage. A low premium might equate to higher out-of-pocket expenses in the event of a claim, thus defeating the purpose of insurance. Seeking a policy that provides good value rather than merely low cost is a prudent approach. Moreover, assessing the reputation and reliability of the insurance provider is indispensable. Reading reviews, checking ratings, and consulting other pet owners can offer insights into the company's track record with claims processing and customer service. A provider with a solid reputation often translates to a smoother experience should you need to make a claim. Finally, it is important not to underestimate the value of customization. Many insurance providers offer flexible plans that can be tailored to suit specific needs, such as adding riders for dental coverage or alternative therapies. Customization ensures that the policy is not only cost-effective but also comprehensive in covering potential health issues specific to your pets. Frequently Asked Questions

https://manypets.com/us/pet-insurance/multi-pet-insurance/

ManyPets offers pet insurance coverage for accidents and illnesses at competitive prices with no hidden fees. https://www.trupanion.com/pet-insurance-faq/article/multi-pet-discount

With multi-dog insurance or multi-cat insurance, you ensure your pets always get the care they need when they need it, and that cost is never a barrier to care. https://www.bankrate.com/insurance/pet-insurance/pet-insurance-for-multiple-pets/

Key takeaways - Multiple pet insurance companies offer a 510 percent discount on any additional pets you insure. - Besides cost savings, pet ...

|